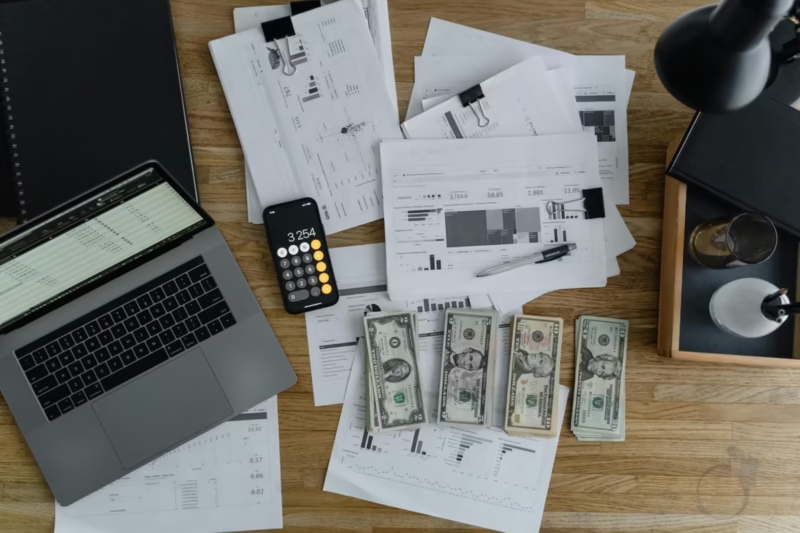

Cash flow can make or break your business—I learned that when PayPal froze $50, nearly sinking my sticker hustle. At Grow Easy Biz, I’ll help you avoid those panic moments with five simple strategies to keep cash flowing, even in tough months. These tips saved me, and they can help you too—let’s dive in!

“Wealth isn’t just about earning more—it’s about managing what you’ve got with clarity and calm.”

Why Cash Flow Is Your Business’s Lifeline

A few months into my sticker side gig, I hit a wall: zero sales for two weeks, then a $50 PayPal freeze—my hosting bill was due, and I had $10 left. A 2024 survey by QuickBooks found 60% of small businesses face cash flow issues yearly, often due to poor tracking or no backup plan. Cash flow isn’t just profit—it’s the money moving in and out to keep your business running. Without it, you’re one bad month from closing shop. Here’s how I turned panic into control—and how you can too.

5 Tips to Boost Your Cash Flow

These are the strategies that saved me—practical and beginner-friendly:

- Track Every Dollar Like a Hawk

- I started logging every penny in a free Google Sheet—$20 in sales, $5 PayPal fees, $3 hosting. It took 10 minutes daily but showed me where money leaked (e.g., $10 on snacks!). Use a free tool like Wave to automate this—it tracks income and expenses, so you always know what’s coming and going.

- Build an Emergency Fund—Even $10 Counts

- After my PayPal scare, I stashed 10% of every sale in a savings account—now I’ve got $150 as a buffer (covers three months of hosting). Aim for 3–6 months of expenses (e.g., $100–$300 for basics like hosting). Start small: save $10 this week, then add more as sales grow—it’s your lifeline for tough months.

- Cut Costs Before They Cut You

- I slashed $15/month on stock photos by switching to free Pexels images for my site. Look at your expenses—what’s not earning its keep? Skip premium tools (e.g., $20/month apps) and use free ones (e.g., Canva for design) until you’re stable. Every dollar saved buys you breathing room.

- Plan for Slow Months with a Buffer Sale

- When sales dipped, I ran a “buy one, get one half-off” deal on stickers—brought in $50 fast. Plan a mini-sale or bundle (e.g., $5 e-book + $2 template) to boost cash flow during slumps. Promote it on Instagram for free—#SmallBizDeals got me 10 extra buyers.

- Negotiate Better Deals with Vendors

- I approached my hosting provider (Namecheap) and negotiated a $1/month discount by committing to a year—saved $12 annually. Call or email your suppliers (e.g., printing services, software) and ask for a lower rate or trial. Even a $5 reduction adds up, keeping cash flowing when times get tight.

What If You’re Already in a Cash Crunch?

I’ve been there—heart racing, bills looming. When PayPal froze my funds, I thought, What if I can’t recover? But small moves saved me: I tracked tighter, saved $5 weekly, ran a sale, and negotiated a deal. If you’re strapped, focus on one fix—cut a $10 cost or call a vendor. Ask: What’s one expense I can drop or negotiate today? One step forward keeps you in the game, even when cash feels tight.

Final Takeaways: How to Strengthen Your Cash Flow

Smart cash flow management is about taking control before problems arise. Track every dollar, build a safety net, cut unnecessary costs, plan buffer sales, and negotiate better deals. These five tips helped me survive a $50 freeze and grow my hustle to $200/month—without stress.

Tough months don’t have to break your business—they can actually make you more financially savvy. Start today: log your expenses with Wave [link], renegotiate a bill, or launch a flash sale. Need help? Drop your biggest cash flow challenge in the comments, and let’s brainstorm together!

Leave a Reply